Louis Divorce Mediation ~ Online and In-Person Mediation in Chicago

|

We’ve established, in the previous blog, that it’s a good idea as you consider divorce to put together a budget to begin planning for your separate financial futures. Now let’s talk about the tools you’ll need to accomplish that, and then look at some tips that can keep you from losing your mind in the process!

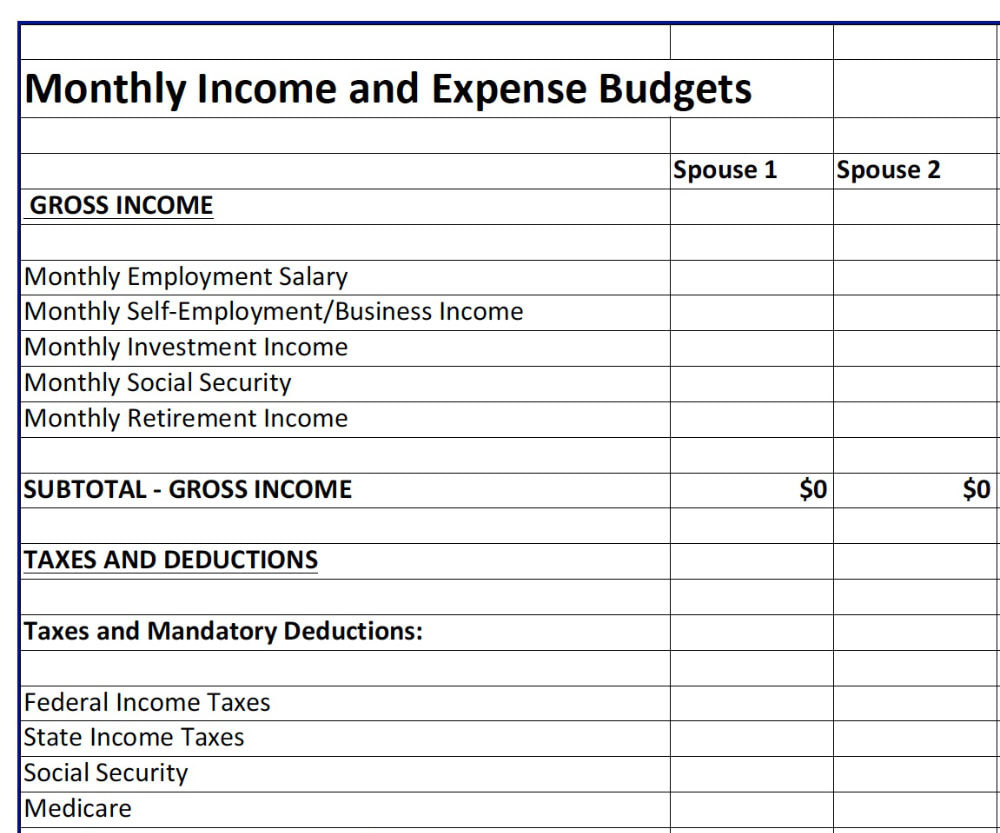

Budgeting Tools I. The Budget Worksheet When I work with clients, I tell them to think of a budget as a list. There are two parts to this list:

Income The first part of the worksheet addresses sources of income, which may include the following:

Additional deductions from a paycheck are included in the expenses portion of the worksheet. Some deductions may be changing, and others may be optional (like retirement savings). After taxes are deducted from gross income, you will have an estimate of the income available each month. Expenses The second part of the worksheet covers expenses. These are the categories I use for adults:

The children’s budget—an important tool for discussion about how parents can meet the financial needs of their children while living in separate households—has its own set of categories. II. What You Need to Fill Out a Worksheet Your income: A paycheck (if you are paid a wage or salary) is the best source of information. If you receive other sources of income, look at the statements that detail that income. Your expenses: Estimate expenses by looking at your bank records and credit card statements for the past year. This will give you a sense of your spending history. Many clients can access information online, as so much billing is done electronically. And in some cases, your memory may be your best friend. For example, in considering vehicle expenses, think about how often you fill up and how much it costs when you do. Budgeting Tips The past is not the future. Use the freedom of starting a new chapter to think ahead and adjust your priorities, estimating what it will cost to live the life you envision. Use the freedom of starting a new chapter to think ahead and adjust your priorities, estimating what it will cost to live the life you envision. For example, if you know that your housing situation is going to change, do the research into what it will cost to rent a new place or what the mortgage might be on a new home. Remember: expenses that applied to both of you or that applied only to your spouse will need to be adjusted to reflect your living in separate households. Try to be accurate instead of precise. Remember, this is a planning document, and it is also a starting point, so the numbers will change. Therefore, try to be realistic about your estimates while, at the same time, not overstressing about precision. You are not being asked to be an accountant. Just do your best. Don’t be afraid to ask for help. Not everyone likes to work with numbers, and my guess is most people don’t. But maybe you have a friend or financial planner or other professional who can help. There are Certified Divorce Financial Analysts (CDFAs) who specialize in this work. I am one of them, and I often help my mediation clients to develop their budgets. Budgets are the start, not the finish. If your future budget puts you in a hole, don’t panic—that is just a starting point. When I am working with clients, my aim is to help both understand each other’s financial futures, which may mean that one will need financial assistance from the other, either in the form of spousal maintenance (to assist a lower-earning spouse) or child support/cost sharing for children’s expenses (to make sure that children can live in two sustainable households). Use the children’s budget to focus on their needs. As you begin the journey ahead, use the children’s budget as a separate plan, independent of each of you individually. The children’s budget can be a valuable tool for parents to get on the same page about how to provide children with stability and to support their bright futures. Budgeting is only part of the process of ending a marriage, but it can be an important step to begin to envision your separate lives and remove uncertainty around your own and your children’s futures. As an experienced divorce mediator as well as a Certified Divorce Financial Analyst, I can help. Contact me for a consultation.

1 Comment

12/6/2022 03:24:38 pm

You make a great point about budgeting groceries. I find that we spend way too much on food we don't need. We'll have to consider getting an advisor to help us with our budget.

Reply

Leave a Reply. |

Categories |

David Louis, MPA, CDFA® • Louis Mediation Services - Chicago

|

Chicago Office: 1700 W Irving Park Rd., Suite 105, Chicago, IL 60613

Northbrook Office: 555 Skokie Blvd., Suite 500, Northbrook, IL 60062 |

Copyright © 2024

RSS Feed

RSS Feed